Groupon is about to go IPO in the USA. The failing stock market, the Euro problems, the faltering US Dollar and Groupon's own consistent mistakes make me think that Groupon's IPO will either be postponed or a great disappointment for investors.

I've said many times that Groupon was going to be a massive failure. The most recent was a post about how Groupon has disappeared from the face of the earth (in Japan). For more on that, refer to The Great Groupon Disappearing Act:

Recently, Groupon Japan has completely dropped off the map. I never see their online ads anymore at all (sign of over extension) yet you see their competition all over the place.

The biggest two that seem to be kicking Groupon (hereinafter referred to as "Groupoff") in the royal behind is a new-comer called G-Market and Recruit's own Pompare.

You see online banner ads for these two constantly. I haven't seen an online ad for Groupon for 9 weeks in a row now (and trust that I am on the Internet constantly).

The other thing that makes me realize that Groupon Japan is almost as messed up as Groupon in the USA is the fact that, while you see no banner ads for Groupon in Japan on the Internet anymore, if you watch a minor cable TV network (I think it is J-com) you see their ads every once in a while.

Let me ask you a question: What kind of an idiot advertises an internet business on TV yet doesn't advertise on the internet at all?

Last year, when start-up Groupon refused a $6 billion dollar offer from Google, you just knew that CEO Andrew Mason and Groupon owners must be smoking some very good weed. Couple that with his stupid followup to the Japan New Year's Oseichi Ryori disaster, along with Groupon's cost versus sales reports and you have a sure-fire loser.

Groupon advertised the above and delivered the below.

It all goes back to a well worn stubborn and obstinate attitude that foreigners have when they bring heir business to Japan. Please refer to Groupon Ex-Partner Chimes In:

Groupon has committed the Cardinal sin that many companies from the west committed before in this country; they came to Japan and didn't make the effort to understand the Japanese and this country well enough. Now they will pay the price for that mistake. I've written before in an article entitled, "How New Companies Can Succeed in Japan - and How They Fail." It's about how, in spite of the fact that giant players from the west came to Japan, with great products and a successful track record in the west - such as Pepsi Cola, Universal Studios, E-Bay, Carrefours, etc. - they failed miserably because they didn't take the time to learn the intricacies of Japan and how to do business here.

The companies that do well here, Disney, Coca-Cola etc. Did bother to understand the market and now they dominate. McDonald's, in fact, even changed their name to fit in with Japanese pronunciation! McDonald's in Japan is not McDonald's. It is "Makudonarudo." Go up to any Japanese and ask them where a McDonald's is and they won't have any idea what you are talking about.

But I digress...

Groupon, I predict is the next in a long line of failures in Japan. In fact, today I met with a friend who is the head editor of one of the biggest magazines in Japan and this editor said, "There's no way for that company, Groupon... Their reputation is already shot. And, in Japan, reputation is everything. The women don't trust it."

This was the first time that someone who knows how the average Japanese woman feels telling me what I had already suspected; Groupon Japan has a terrible reputation with the women in Japan and it's getting worse.

Now, today, once again, we have another example of Groupon gross mismanagement.

When a company files for the right to sell Initial Public Offerings (IPO) they must, according to SEC rules, go into a "quiet period" whereby potential investors are able to go over their company reports and sales, etc. to come up with ideas of potential value. It is against rules for that company to be making public announcements that may slant or create unjust publicity for that company.

But, just as with the inept handling of the Japan New Year's deal, Groupon CEO Mason has gotten himself in trouble again with making company announcements that he must have known would be leaked to the public.

Yahoo reports:

Commentary: Has the company run afoul of quiet-period rules?

Daily-deal pioneer Groupon Inc. appears to be hell-bent on becoming the poster child for business schools and budding entrepreneurs on how not to go public.

Since the company filed its IPO prospectus for potential investors on June 2, Groupon appears to be close to running afoul of the "quiet period" that is required of businesses once they file with the Securities and Exchange Commission.

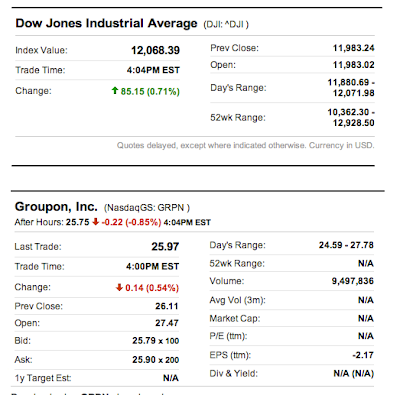

Last month, Chief Executive Andrew Mason wrote a memo to employees about a story he had read (in the car, while driving alone, apparently). The report, one in a barrage of negative stories in recent months, wondered whether Groupon is running out of cash. Mason wrote a long defense of his company's business model, its stance against rivals and an explanation of the bizarre accounting metric used in Groupon's financials that raised eyebrows with regulators. (His message to the troops was obtained by our colleagues over at AllThingsD. Read Mason's full memo. Last week, an outside PR person for Groupon pointed another reporter in the direction of that same email, fueling speculation that the memo was written by Mason knowing that it would be leaked. Read Private Equity Hub's run-in with Groupon. Let me predict right here that the Groupon IPO will either be postponed or a failure. Couple this bad publicity and inept management with the current serious decline in stock prices and you have the ripe situation for Groupon IPO to be valued at something like $20 a share. That would be a massive failure.

The situation gets worse when you see that the recently hired PR expert by Groupon has already quit and you can just smell the scent of an organization that is demoralized and in disarray.

In addition to the furor over the email sent to staff, Silicon Valley PR veteran Brad Williams, hired only two months ago as Groupon's head of corporate communications, recently quit. A Groupon spokeswoman said it was a mutual decision; Williams did not return calls, but reports indicate that he may have butted heads with Mason.

"It just doesn't seem to get uglier than this," said Rocky Agrawal, an entrepreneur who advises start-ups, of the company's IPO process so far. Agrawal has found serious problems in Groupon's financials and has written about his concerns.

Attorneys appear to be split on whether Groupon has violated the SEC's rules, and whether employee communications can be considered speaking to potential investors. In 1996, San Francisco-based Wired had to pull its IPO after magazine publisher Louis Rossetto wrote a similar rally-the-troops email. In 2005, the SEC revamped its rules, albeit slightly.

It is reasonable to think that Mason wrote the memo purely to spur morale, feeling frustrated by the restrictions imposed by the SEC. But how he handled this communication is calling attention to his leadership.

Seriously? After all these screw ups, with the Super Bowl ads, Japan, etc., etc., people are just now figuring out that something isn't quite right with the CEO? You're kidding me!

Mason has fashioned himself as a sort of David Letterman CEO — quirky and funny, with an odd sense of humor that pervades the company, its deals and even its poorly received Super Bowl ads in February.

But he cannot be so naive as to not realize that sending out a lengthy, defensive-sounding email to thousands of employees would not end up in the press eventually. There are other, more concise ways Mason could have communicated. He also barely reminded employees of the regulatory restrictions that Groupon is under, only to say "we've refrained from defending ourselves publicly," and that "for now we must patiently and silently endure a bit more public criticism as we prepare to birth this IPO baby."

Under the harsh spotlight of the IPO, when companies are required to refrain from actions that might be seen as pumping up the stock ahead of the debut, Mason's behavior seems childish and impetuous.

"I have been doing this a long time," said Scott Sweet, senior managing partner at the IPO Boutique, about following the market for initial public offerings. "That IPO really bothers me."

Sweet's concerns include the issues that have been noted in recent months: the firm's high marketing costs, major competitors and heavy losses. But he is also now calling out Mason, Groupon's eccentric chief.

"No matter how the CEO spins it, he is not talking to the choir," Sweet added. "He is talking to his ego."

Whether this brouhaha will affect how Groupon is received by investors has yet to be seen. The company has not yet started its road show to tell its story. But so far, it's serving as a textbook case on what not do to during the IPO process.

Here's a few more tidbits that I have gathered about Groupon that alert readers may be interested in: Groupon grossed $700 M (USD) but spent $413 M (USD) on advertising.

What is the Groupon business model? It is SPAM. Send people spam. In the day and age of Social Media and Social Media Marketing the utter idea that Groupon would attempt to grow their business without a marketplace or social media component and just email seems to be to be absurd. This is a massive failure.

Groupon in Japan has over 600 people employed in sales going door to door trying to get deals. They use email to sell. That they wouldn't create a marketplace, not have any plan to, shows a lack of understanding of Internet 2.0 and today's Internet users.

Groupon was a great business model two years ago, when there were no competitors. But now, there are many. And those competitors have or are building marketplace portals. I cannot comment too much about the rest of the world, but, at least in Japan, Groupon is dead.

Like I said, the failing stock market, the Euro problems, the faltering US Dollar and Groupon's own consistent (and constant) mistakes make me think that Groupon's IPO will either be postponed or a great disappointment for investors.

Of course it will. There's too many bad factors running against Groupon.

Come to think of it, have you heard anything good about that company in the last 6 months? I haven't.

Groupon, I predict, will be the business world's poster child for these turbulent times; a highly touted and very visible new company jumps from the starting gates on the crash headlong into reality and the real world. Throw in shady business and accounting practices and you have a model reflection of the US government...

Shady business and accounting practices? US government? Everyone knows how well the US government is doing!

Hello Groupon! welcome to IPO in the stock market crash of Autumn 2011. As with everything you've done so far, your timing is impeccable.

UPDATE: As I predicted:

Thanks to Jeff Behr