Pretty shocking stuff. Especially if you own shares in this company!

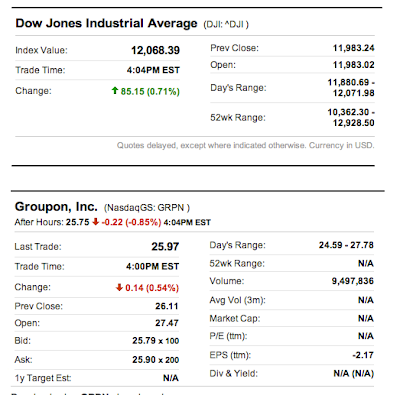

On Monday, Nov. 21, 2011. The Dow Jones Industrials (DJI) had a bad day dropping 249 points or -2.1% to finish at 11,454. The NASDAQ Composite Index (IXIC) closed 1.92% lower at 2,529.14. On the other hand, Groupon (GRPN) had an even worse day by dropping almost 10% and another nearly 1% after-hours! See chart:

Today, Tuesday Nov. 22, 2011 (USA time) it wasn't as bad as yesterday's market saw the DJI down 53.59 or -0.49% to finish at 11,493.72. The NASDAQ closed 1.86% lower at 2,521. But! Groupon was one of the top three losers for the day dropping a whopping 3.51 or -14.89% to close at nearly their IPO price. The final closing was 20.07.

Head for the life rafts! If anyone knows where or how they can short GRPN shares, please comment and let us all know. Opportunities of a lifetime, like this one, don't come very often.

As I have written over and over before, a business model built on SPAM mail isn't a good business model at all. They should have built a portal. They should have taken Google's $6 billion dollar offer.

I'll make a prediction here: GRPN stock price will be under $1.00 by December 15, 2012 So if you want to be stupid and "BUY" then wait for their 60% off coupons! (Or, as Karl Denninger says, "There's crazy and then there's really crazy!")

UPDATE: Zerohedge writes, "Groupoff - Groupon back to IPO price":

As of this moment, everyone who has bought and held GRPN stock since the IPO price is at best flat, and almost certainly at a massive loss, as only a few banks were allotted shares at the $20.00 offering price, which were quickly flipped to subsequent greater fools. As of this moment, GRPN is back to the IPO price or precisely $20.00. We expect once this is taken out for the one way Grouponzi Red Light Special to fair value, somewhere around $0.00, to take a few months at most.

PS: I have made some really good bucks buying and selling stocks over these 35 years... Actually, only three. I've only ever bought three times. I won big three times. Great opportunities only come once every ten years or so (unless you have insider information) one day soon I will write about these exploits. I found these chances of a lifetime just simply from reading the news. You can too. Sometimes things are just painfully obvious. As a loser, Groupon was one of them.

Had I been able to invest huge money instead of my piddling amounts, on the good ones....I might have been rich!

Or as my wife says:

NEW YORK (AP) -- A look at the 10 biggest percentage decliners on Nasdaq at the close of trading:

School Specialty Inc. fell 26.4 percent to $5.17.

Groupon Inc. fell 14.9 percent to $20.07.

First Clover Leaf Financial Corp. fell 11.6 percent to $5.74.

Viasystems Group fell 10.9 percent to $15.77.

ID Systems Inc. fell 9.7 percent to $5.14.

Mackinac Financial Corp. fell 9.6 percent to $5.00.

Technical Communications Corp. fell 9.6 percent to $7.17.

Forbes Energy Services Ltd. fell 9.2 percent to $5.35.

KIT Digital Inc. fell 9.2 percent to $9.52.

Lihua Intl fell 8.8 percent to $5.36.

Yet another fatal flaw in GRPN's business model is revealed to the sheeple IPO buyers.

- International Business Times